Did you know that a Life Insurance policy...

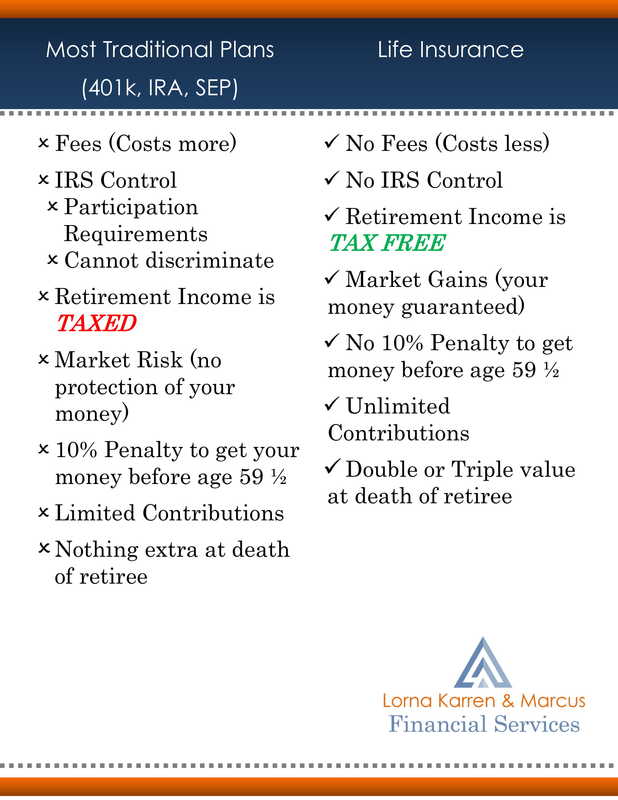

Supplementing Retirement IncomeThe tax advantages of 401(k)s and IRAs come with contribution and income limits. Life insurance can offer ways to bolster retirement income in a tax-advantaged vehicle that simultaneously offers the comfort of death benefit protection.

What is Life Insurance in Retirement Planning?In the event of premature death during the client’s working years, the income tax-free life insurance death benefit can protect the family and replace income for survivors. At retirement, the client can access the policy cash value through tax-favored loans and withdrawals.

|